Our Investment Strategy

LAYING THE GROUNDWORK FOR SUCCESS

Why Student Housing

1. Specialized & High Barrier to Entry:

Student housing remains a specialized and high barrier-to-entry asset class within the real estate sector. This unique characteristic presents an opportunity to acquire exceptional assets at fair prices.

2. Consistent & Predictable Cash Flows:

Student Housing offers consistent and predictable cash flows thanks to its non-cyclical nature. All leases are based on the academic school year and reset yearly which allows for precise forecasting and consistent rent growth.

3. Record High Fundamentals:

Fundamental indicators for student housing are at record highs. Major Tier 1 university markets across the United States are currently experiencing unparalleled levels of occupancy, pre-leasing activity, and rental rates.

4. Resilience & Recession-Proof Nature:

The industry has historically outperformed during negative macroeconomic events, including the Global Financial Crisis and the COVID-19 pandemic, further solidifying its status as a resilient investment choice.

Investment Criteria

Asset Type

Purpose Built Student Housing Properties Near Public 4-Year Universities.

Location

Universities in the Southeast, Southwest, and Midwest United States.

Market Criteria

Average market occupancies of over 90% with little to no new planned construction.

University Criteria

Public, Tier-1 universities with 20k+ enrollment and strong athletic programs (Power 5).

Price Per Bed

Substantially below replacement cost dependent on vintage and market.

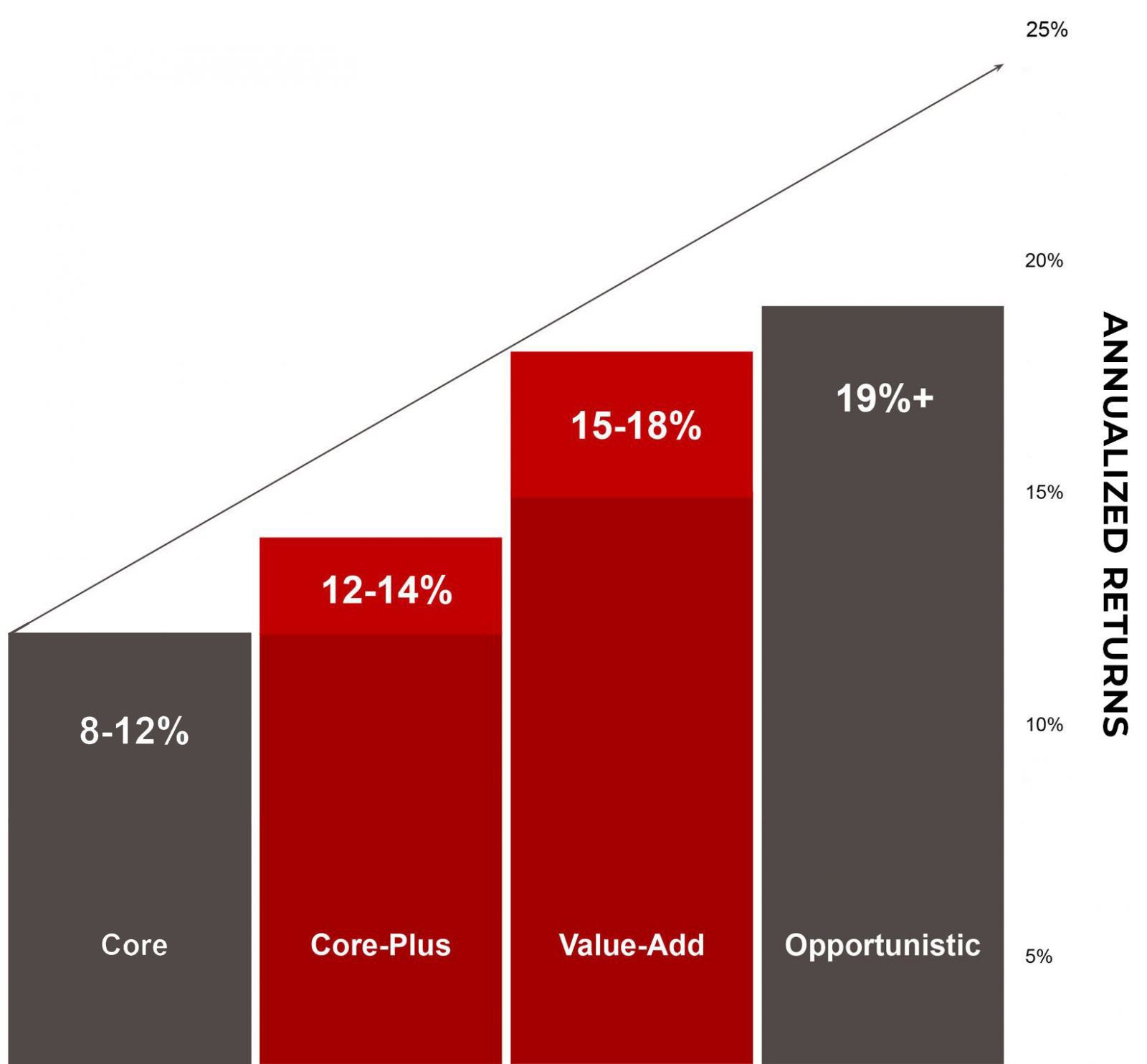

Return Profile

12-18% Annualized.

Target Leverage

Target Hold Period

3-5 Years.

Acquisition Strategy

Acquisition Process

Typical Deal Profile

$20-$60M

Price

300+

Beds

2000s+

Vintage

A & B

Class

Source

We have excellent deal flow which allows us to screen hundreds of on and off-market properties.

01

Review

Conduct an initial review of the properties in our target markets that fit our typical deal profile.

02

Underwrite

Underwrite 100+ properties per year which pass our initial review period.

03

Offer

Submit over 20 LOI’s per year on properties which fit our strict investment criteria.

04

Acquire

Look to acquire 1 property per quarter at a minimum.